Market Outlook

April 26, 2018

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Cl ose)

Indian markets are likely to open flat tracking global indices and SGX Nifty.

BSE Sensex

(0.3)

(115)

34,501

U.S. Stocks showed a lack of direction over the course of the trading day. The major

Nifty

(0.4)

(44)

10,571

averages spent the day bouncing back and forth across the unchanged line before

Mid Cap

(0.5)

(88)

16,789

closing mixed. The Dow Jones ended up by 0.3 percent to 24,083 and the Nasdaq

Small Cap

(0.7)

(131)

18,119

fell by 0.1 percent to 7,003.

Bankex

(1.1)

(302)

27,733

U.K. stocks fell after Wall Street stocks sold off overnight on concerns over rising

bond yields amid expectations of more Fed rate hikes this year. The FTSE 100 was

Global Indices

Chg (%)

(Pts)

(Cl ose)

down by 0.7% to end at 7,377.

Dow Jones

0.3

60

24,083

On domestic front, Indian shares fell modestly during the last trading session due to

Nasdaq

(0.1)

(4)

7,003

amid fears of rising oil prices and a falling rupee that can hurt India's growth

FTSE

(0.7)

(47)

7,377

prospects. Other than that weak global cues also dented sentiment. The BSE Sensex

Nikkei

(0.3)

(63)

22,215

ended down by 0.3% at 34,501.

Hang Seng

(1.0)

(308)

30,328

News Analysis

Shanghai Com

(0.4)

(11)

3,118

India, World Bank sign $210 mn deal to improve Madhya Pradesh rural roads

Detailed analysis on Pg2

A dvances / Declines

BSE

NSE

Advances

915

789

Investor’s Ready Reckoner

Declines

1,755

1,020

Key Domestic & Global Indicators

Unchanged

144

65

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg5 onwards

Volumes (` Cr)

Top Picks

BSE

3,380

C MP

Target

U psi de

C ompany

Sector

R ating

(`)

(`)

(%)

NSE

32,815

Blue Star

Capital Goods Accumulate

797

867

8.9

Dewan Housi ng Finance

Financials

Buy

609

720

18.2

Net Inflows (` Cr)

Ne t

Mtd

Ytd

Century Plyboards

Forest Product

Buy

338

400

18.4

FII

(257)

(4,305)

9,303

Navkar Corporation

Others

Buy

175

265

51.7

*MFs

409

8,173

42,632

KEI Industrie s

Capital Goods Accumulate

428

485

13.2

More Top Picks on Pg4

Top Gainers

Price (`)

Chg (%)

Key Upcoming Events

Previous

C onsensus

LTI

1,717

11.6

D ate

Region

Event Description

ReadingExpectations

IBVENTUREPP

254

10.0

Apr 26, 2018 US

Initial Jobless claims

232.00

230.00

IBVENTURES

470

9.7

Apr 26, 2018 Euro Zone ECB announces interest rates

-

-

Apr 27, 2018 US

GDP Qoq (Annualise d)

2.90

2.00

NIITTECH

1,081

8.3

Apr 27, 2018 Euro Zone Euro-Zone Consumer Confidence

0.40

RAYMOND

1,132

6.3

Apr 27, 2018 Germany Unempl oyment change (000's)

(19.00)

(15.00)

More Events on Pg7

Top Losers

Price (`)

Chg (%)

PCJEWELLER

244

-15.6

HATHWAY

32

-8.6

TIMETECHNO

165

-5.8

BAJAJCORP

465

-5.5

WELCORP

138

-5.3

As on April 25, 2018

Market Outlook

April 26, 2018

News Analysis

India, World Bank sign $210mn deal to improve Madhya Pradesh rural roads. The

Government of India, the Government of Madhya Pradesh and the World

210 million dollar loan agreement for the Madhya

durability, resilience, and safety of the gravel-surfaced rural roads and enhance

the capacity of the state to manage its rural roads network.

The new joint project will cover 10,510 km stretch of rural roads in Madhya

Pradesh that fall under the Chief Minister's Gram Sadak Yojana (CMGSY)

programme. Of this, 10,000 km will be upgraded from existing gravel to

bituminous surface roads, while 510 km of new roads will be built to the same

bituminous surface standard. "This project will leverage resources to support

innovations in road construction, improve road safety, and reduce carbon footprint

design and construction," added Hisham Abdo, Acting Country Director, World

Economic and Political News

7th Pay Commission: Bonanza for J&K government employees; April pay to

Corporate News

Infosys, Wipro, 5 other firms see 43% drop in H1-B approvals in past 3 yrs

Capri Global to float $150-mn distressed asset fund for SMEs facing IBC

KWAN Entertainment and Ravi Krishnan partner to launch KWANAbler

Bharti Infratel, Indus merge, create world's largest non-Chinese tower firm

IDBI Federal Life Insurance's FY18 net profit soars by 94% to Rs 1 billion

Market Outlook

April 26, 2018

Quarterly Bloomberg Brokers Consensus Estimate

YES Bank Ltd - April 26, 2018

Particulars ( ` cr)

4QFY18E

4QFY17

y-o-y (%)

3QFY18

q-o-q (%)

PAT

1,085

914

19

1,077

1

Axis Bank Ltd - April 26, 2018

Particulars ( ` cr)

4QFY18E

4QFY17

y-o-y (%)

3QFY18

q-o-q (%)

PAT

662

1,125

(46)

726

(9)

Market Outlook

April 26, 2018

Top Picks

Market Cap

C MP

Target

Upside

C ompany

R ationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its

leadership in acute therapeutic segment. Alkem

Alkem Laboratories

23,132

1,935

2,441

26.2

expects to launch more products in USA, which

bode s for its internati onal business.

Favorable outlook for the AC industry to augur well

for Cooling products business which is out pacing

Blue Star

7,647

797

867

8.9

the market growth. EMPPAC division's profitability

to improve once oper ating environme nt turns

around.

With a focus on the low and me dium income (LMI)

consumer se gment, the company has increase d its

Dewan Housi ng Finance

19,107

609

720

18.2

presence in tier-II & III cities where the growth

opportunity i s immense.

Well capitalized with CAR of 18.1% which give s

sufficient room to grow asset base. F aster re solution

ICICI Bank

1,79,280

279

416

49.2

of NPA would reduce provi sion cost, which would

help to re port better ROE.

High order book execution in EPC segment, rising

KEI Industrie s

3,357

428

485

13.2

B2C sales and hi gher exports to boost the revenue s

and profitability

Expected to benefit from the lower capex

Music Broadcast Limited

2,200

386

475

23.2

requirement and 15 year long radio broadcast

licensing.

Massive capacity expansion along with rail

Navkar Corporation

2,629

175

265

51.7

advantage at ICD as well CFS augur well for the

company

Strong brands and distribution network would boost

Siyaram Silk Mills

3,154

673

851

26.4

growth goi ng ahe ad. Stock currently trades at an

inexpensive valuation.

Market leadership in Hindi news genre and no. 2

viewership ranking in English news genre, exit from

TV Today Network

2,804

470

603

28.3

the radio busine ss, and anticipated growth in ad

spends by corporate to benefit the stock.

After GST, the company is expected to see higher

volume s along with improving product mix. The

Maruti

2,70,004

8,938

10,619

18.8

Gujarat plant will also enable higher operating

leverage which will be margin accretive.

We expect loan book to grow at 24.3% over next

GIC Housing

2,260

420

655

56.1

two year; change in borrowing mix will help in NIM

improve ment

We expect CPIL to report net Revenue/PAT CAGR of

~17%/ 16% over FY2017-20E mainly due to

Century Plyboards

7,507

338

400

18.4

healthy growth in plywood & lamination busine ss,

forayed into MDF & Particle boards on back of

strong brand & distribution network.

We expect sales/PAT to grow at 13.5%/ 20% over

LT Foods

2,973

93

128

37.7

next two years on the back of strong di stribution

network & addition of new products in portfolio.

Third large st brand play in luggage segment

Increase d product offerings and improvi ng

Safari Industries

1,502

675

750

11.1

distribution network is leading to strong growth in

busine ss. Likely to post robust growth for next 3-4

years

We expect HSIL to report PAT CAGR of ~15% over

FY2017-20E owing to better improve ment in

HSIL Ltd

2,792

386

510

32.1

operating margi n due price hi ke in container glass

segment, turnaround in consumer busine ss.

Source: Company, Angel Research

Market Outlook

April 26, 2018

Top Picks

Market Cap

C MP

Target

Upside

C ompany

R ationale

(` Cr)

(`)

(`)

(%)

We expect financi alisation of savings and

Aditya Birla Capital

33,840

154

230

31.33

increasing penetration in Insurance & Mutual fund

would ensure steady growth.

One of the leading Indi an dairy products

companie s in India create d strong brands in dairy

products. Rising revenue share of hi gh-margin

Parag Milk F oods

2,520

300

333

12.1

Value Added Products and reduction in interest cost

is likely to boost margins and e arnings in next few

years.

We expect MCL to report net revenue CAGR of

~15% to ~`450cr over FY2018-20E mainly due to

strong growth in online matchmaking & marriage

Matrimony.com Ltd

1,928

849

984

15.9

related services. On the bottom-line front, we

expect a CAGR of ~28% to `82cr over the same

period on the back margin improve ment.

Source: Company, Angel Research

Fundamental Call

Market Cap

C MP

Target

Upside

C ompany

R ationale

(` Cr)

(`)

(`)

(%)

CCL is likely to maintain the strong growth trajectory

CCL Products

3,940

296

360

21.6

over FY18-20 backed by capacity expansion and

new geographical foray

We forecast Nilkamal to report top-line CAGR of

~9% to `2,635cr over FY17-20E on the back of

Nilkamal

2,504

1,678

2,178

29.8

healthy demand growth in plastic divi sion. On the

bottom-line front, we esti mate

~10% CAGR to

`162cr owing to improve ment in volumes.

The prism has diversified exposure in the different

segment such as Ceme nt, Tile & ready mix concrete.

Prism Cement

5,824

116

160

38.3

Thus we believe, PCL is in the right place to capture

ongoing government spendi ng on affordable

housing and infrastructure projects.

Elantas Beck India is the Indian market leader in

liquid insulation segment used in electrical

equipme nts like motors, transformers etc. It derives

Elantas Beck India Ltd

1,765

2,226

2,500

12.3

demand from several industries which are expected

to register 10%+ CAGR in demand in the coming

years.

Greenply Industries Ltd (GIL) manufactures plywood

& allied products and me dium density fibreboards

(MDF). GIL to report net revenue CAGR of ~14% to

Greenply Industries

3,767

307

395

28.6

~`2,478cr over FY2017-20E mainly due to healthy

growth in plyw ood & lamination busine ss on the

back of strong brand and di stribution network

Ashok Leyland Ltd (ALL) i s the flagship company of

the Hinduja Group, and one of the largest

commercial vehicle manufacturers in India. Ashok

Ashok Leyland

48,051

164

-

-

Leyland expected to report net Profit (reporte d)

CAGR of ~19% to ~`2,075cr over FY2017-20E

mainly due to improve ment in re placeme nt de mand.

GMM Pfaudler Limited (GMM) is the Indian market

leader in glass-lined (GL) steel equipment. GMM is

expected to cross CAGR 15%+ in revenue over the

GMM Pfaudler Ltd

1,126

770

861

12

next few years mainly led by uptick in demand from

user industries and it is also expecting to increase its

share of non-GL business to 50% by 2020.

Market Outlook

April 26, 2018

Key Upcoming Events

Result Calendar

D ate

C ompany

April 26, 2018

Rallis, Ye s Bank

April 27, 2018

Axis Bank, Shriram Trans, Reliance Industries

Source: Bloomberg, Angel Research

Global economic events release calendar

Bl oomberg Data

D ate

Time

C ountry

Event Description

Unit

Period

L ast Reporte d

E stimate d

Apr 26, 2018

6:00 PMUS

Initial Jobless claims

Thousands

Apr 21

232.00

230.00

5:15 PMEuro Zone ECB announces interest rates

%

Apr 26

-

-

Apr 27, 2018

6:00 PMUS

GDP Qoq (Annualise d)

% Change

1Q A

2.90

2.00

2:30 PMEuro Zone Euro-Zone Consumer Confidence

Value

Apr F

0.40

1:25 PMGermany Unempl oyment change (000's)

Thousands

Apr

(19.00)

(15.00)

2:00 PMUK

PMI Manufacturing

Value

Apr

55.10

Apr 30, 2018

2:00 PMUK

GDP (YoY)

% Change

1Q A

1.40

1.40

May 01, 2018

6:30 AMChina

PMI Manufacturing

Value

Apr

51.50

51.20

May 02, 2018

1:25 PMGermany PMI Manufacturing

Value

Apr F

58.10

11: 30 PMUS

FOMC rate decision

%

May 2

1.75

1.75

2:30 PMEuro Zone Euro-Zone GDP s.a. (QoQ)

% Change

1Q A

0.70

May 04, 2018

1:25 PMGermany PMI Services

Value

Apr F

54.10

6:00 PMUS

Change in N onfarm payrolls

Thousands

Apr

103.00

185.00

6:00 PMUS

Unnemployment rate

%

Apr

4.10

4.00

May 08, 2018

China

Exports YoY%

% Change

Apr

(2.70)

Source: Bloomberg, Angel Research

Market Outlook

April 26, 2018

Macro watch

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

8.5

10.0

9.0

9.1

7.4

9.0

8.0

7.1

7.1

8.0

8.1

7.0

7.6

7.6

8.0

7.3

7.2

7.2

6.0

6.8

4.8

7.0

6.5

5.0

4.1

6.1

5.7

4.0

3.2

6.0

2.9

3.0

1.8

5.0

2.0

1.0

4.0

1.0

-

3.0

(1.0)

(0.3)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

6.0

54.0

5.2

5.1

4.9

52.0

5.0

4.4

4.3

50.0

4.0

3.6

3.3

3.3

3.0

48.0

3.0

2.4

2.2

46.0

2.0

1.5

44.0

1.0

42.0

40.0

-

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Source: MOSPI, Angel Research

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

60.0

6.50

50.0

6.00

40.0

5.50

30.0

5.00

20.0

4.50

10.0

4.00

0.0

3.50

(10.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

April 26, 2018

Global watch

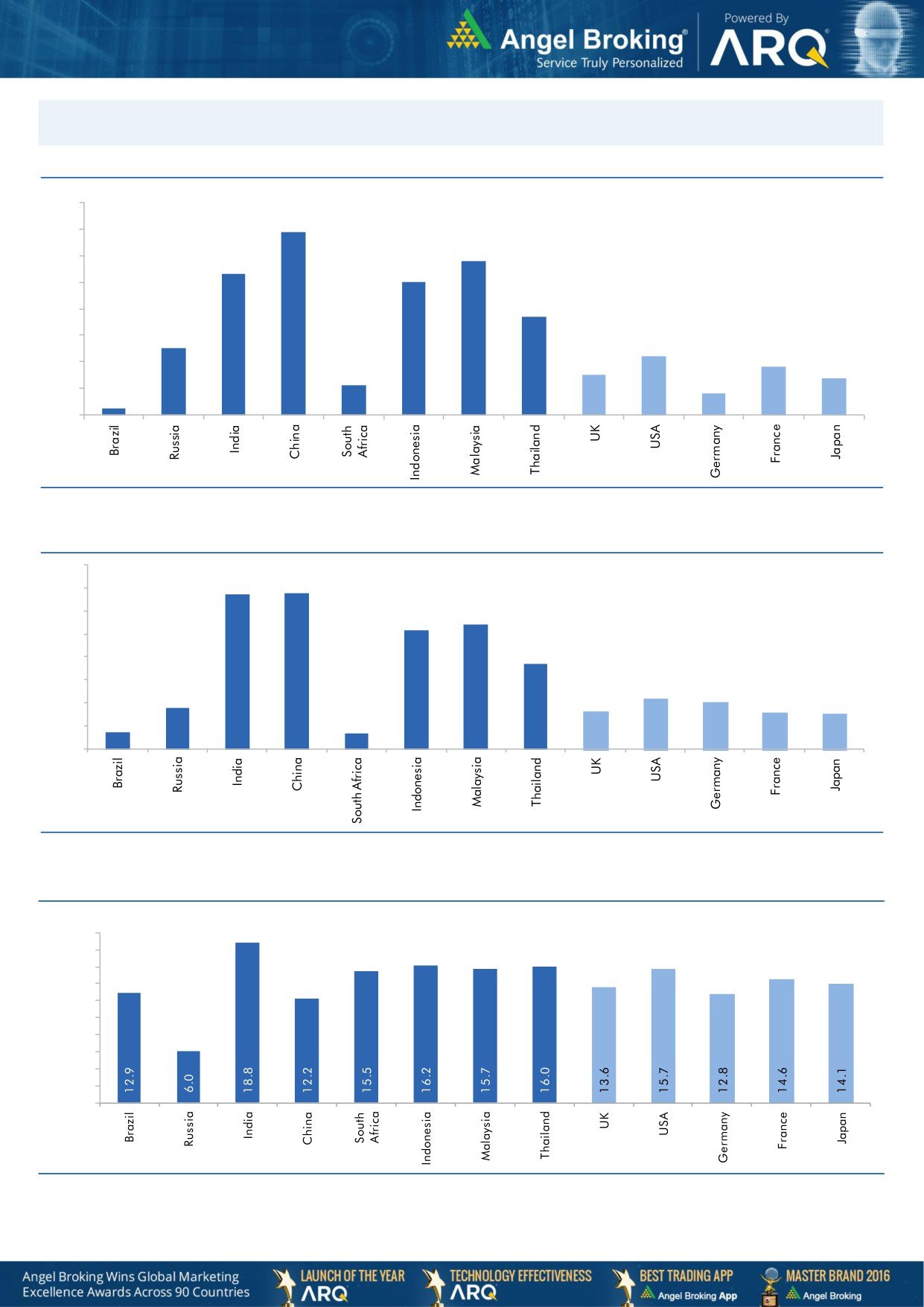

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

7.0

5.8

6.0

5.3

5.0

5.0

1.1

3.7

4.0

2.5

3.0

2.2

1.8

2.0

1.5

1.4

0.8

1.0

0.3

-

Source: Bloomberg, Angel Research

Exhibit 2: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

6.7

6.8

7.0

6.0

5.4

5.2

5.0

3.7

4.0

3.0

1.8

2.2

2.0

1.7

1.6

2.0

0.7

1.5

0.7

1.0

-

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research as on 25 April, 2018

Market Outlook

April 26, 2018

Exhibit 4: Relative performance of indices across globe

Returns (%)

C ountry

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

85,824

2.3

7.6

33.4

Russia

Micex

4,382

1.4

7.1

11.4

India

Nifty

10,565

4.7

(1.7)

16.0

China

Shanghai Composite

3,117

(6.3)

(10.3)

(6.2)

South Africa

Top 40

50,729

(1.3)

(6.2)

10.8

Mexico

Mexbol

48,745

1.9

(1.3)

(0.3)

Indonesia

LQ45

1,040

0.7

(5.9)

10.0

Malaysia

KLCI

1,895

2.1

3.8

9.2

Thailand

SET 50

1,189

0.2

0.7

19.2

USA

Dow Jones

24,665

0.2

(5.6)

19.9

UK

FTSE

7,329

2.3

(5.1)

3.0

Japan

Nikkei

22,191

3.3

(7.0)

19.6

Germany

DAX

12,567

2.9

(5.3)

4.4

France

CAC

5,392

3.7

(1.4)

2.4

Source: Bloomberg, Angel Research as on 25 April, 2018 68in4